Where the worldwide

spectrum community meets

Where the worldwide

spectrum community meets

The 21st European Spectrum Management Conference will take place on 17 – 18 June 2026 in Brussels, Belgium.

Across 2 days attendees will have the opportunity to be involved in discussions on the key spectrum topics for Europe and beyond, through interactive sessions, networking opportunities, an exhibition area and much more.

This event is part of The Global Spectrum Series, The world’s largest collection of regional spectrum policy conferences. Click on the images on the right to find out more about the series and to view the photos from 2025.

Since 2006, the conference has brought together thousands of policymakers, regulators, industry leaders and technical experts to shape the future of wireless connectivity in Europe and beyond.. This event is taking place as part of The Global Spectrum Series.

Over 250 delegates joined 2 days of discussions in Brussels in June 2025. Watch the highlights from the two days below.

Forum Global

Forum Global Forum Global specialises in the organisation of policy-focused conferences on a global level.

Developed in partnership with businesses, institutions, regulators and governments throughout the world, our events provide a platform for stakeholders to engage in topical discussions, strengthen networks and establish new connections.

Since Forum Global’s inception in 2012, we have delivered over one hundred major international conferences across North America, South America, Asia, the Middle East, Africa and Europe.

We are tech policy specialists. We have launched international event initiatives focused on the Internet of Things and 5G, and are the creators of the world’s largest series of global conferences on wireless spectrum management issues – the Global Spectrum Series.

Ericsson

Ericsson Ericsson is a world-leading provider of telecommunications equipment and related services to mobile and fixed network operators globally. Over 1,000 networks in more than 180 countries utilize our network equipment and 40 percent of all mobile calls are made through our systems. We are one of the few companies worldwide that can offer end-to-end solutions for all major mobile communication standards. Communication is changing the way we live and work. Ericsson plays a key role in this evolution, using innovation to empower people, business and society. We provide communications networks, telecom services and multimedia solutions, making it easier for people all over the globe to communicate.

Global mobile Suppliers Association

Global mobile Suppliers Association GSA (the Global mobile Suppliers Association) is a not-for-profit industry organisation representing companies across the worldwide mobile ecosystem who are engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications, and mobile support services.

GSA actively promote the 3GPP technology road-map – 3G; 4G; 5G – and we are a single source of information for industry reports and market intelligence. Their Members drive the GSA agenda and define the communications and development strategy for the Association.

GSMA

GSMA The GSMA represents the interests of mobile operators worldwide, uniting nearly 800 operators with more than 250 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and Internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading events such as Mobile World Congress, Mobile World Congress Shanghai and the Mobile 360 Series conferences.

Qualcomm

Qualcomm Qualcomm’s technologies powered the smartphone revolution and connected billions of people. While many of our inventions and breakthroughs reside “under the hood” of consumer electronics, they have transformed the world in a big way. They have helped propel mobile to the forefront of the technology world and to the top of consumers’ wish lists. They have created new opportunities for mobile ecosystem players — the wireless device makers, the operators, the developers and the content creators of the world. And more recently, our inventions and breakthroughs have inspired fresh, new ideas from those companies — large and small — new to the wireless space. We are engineers, scientists and business strategists. Together, we focus on a single goal — invent mobile technology breakthroughs. We pioneered 3G and 4G — and now, we are leading the way to 5G and a new era of intelligent, connected devices. Our products are revolutionizing industries including automotive, computing, IoT and healthcare, and are allowing millions of devices to connect with each other in ways never before imagined.

Wi-Fi Alliance

Wi-Fi Alliance Wi-Fi Alliance ® is the worldwide network of companies that brings you Wi Fi ® . Members of our collaboration forum come together from across the Wi-Fi ecosystem with the shared vision to connect everyone and everything, everywhere, while providing the best possible user experience.

Since 2000, Wi-Fi Alliance has completed more than 75,000 Wi-Fi certifications. The Wi-Fi CERTIFIED™ seal of approval designates products with proven interoperability, backward compatibility, and the highest industry-standard security protections in place.

Today, Wi-Fi carries more than half of the internet’s traffic in an ever-expanding variety of applications. Wi-Fi Alliance continues to drive the adoption and evolution of Wi-Fi, which billions of people rely on every day.

Broadcast Networks Europe

Broadcast Networks Europe Broadcast Networks Europe is dedicated to maintaining an efficient and fair regulatory and operational environment for Terrestrial Broadcast Network Operators with a view to ensuring European citizens continue having universal access to a broad range of TV and radio programs and content as well as other over-the-air services.

Echostar

Echostar EchoStar Corporation (NASDAQ: SATS) is a premier global provider of satellite communication solutions. Headquartered in Englewood, Colo., and conducting business around the globe, EchoStar is a pioneer in secure communications technologies.

Shure

Shure With a history of innovation that began in 1925, Shure has turned a passion for making great microphones and audio electronics into an obsession.

Shure continues to set the worldwide industry standard for superior, reliable products.

Specure

Specure Specure, an Austrian firm, specializes in developing software for spectrum auctions.

Their EAS auction platform has been fundamental to numerous successful spectrum auctions across Europe and Africa.

Dynamic Spectrum Alliance (DSA)

Dynamic Spectrum Alliance (DSA) The Dynamic Spectrum Alliance (DSA) is a global, cross-industry, not for profit organization advocating for laws, regulations, and economic best practices that will lead to more efficient utilization of spectrum and foster innovation and affordable connectivity for all.

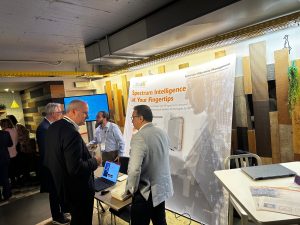

thinkRF

thinkRF thinkRF is one of the proud affiliates of the Wesley Clover International, a serial super angel, found or fund over 100 successful Information and Communications Technologies (ICT) companies, either independently or in partnership with other investors. The portfolio currently consists of public and private firms focused on next-generation Cloud and SaaS applications, hardware and services for fixed/mobile communications, video collaboration, customer engagement, analytics and more.

We are revolutionizing spectrum monitoring and intelligence. We provide ultimate visibility to wireless network operators and national regulatory agencies and empower them to optimize and utilize RF spectrum. We not only provide real-time, but also historical data and insights to guide wireless network operators in making informed decisions about their spectrum policies.

We are the leader in software-defined spectrum analysis platforms that monitor, detect and analyze complex waveforms in today’s rapidly evolving wireless landscape. Spectrum eXperience Management (SXM) is our subscription-based wireless network monitoring and intelligence solution. Wireless network operators can characterize, optimize and protect vital RF spectrum networks with real-time and historical insights on the state of wireless technologies.

Sennheiser

Sennheiser Audio specialist Sennheiser is one of the world’s leading manufacturers of headphones, microphones and wireless transmission systems. Based in Wedemark near Hanover, Germany, Sennheiser operates its own production facilities in Germany, Ireland and the USA and is active in more than 50 countries. With 19 sales subsidiaries and long-established trading partners, the company supplies innovative products and cutting-edge audio solutions that are optimally tailored to its customers’ needs.

LS telcom

LS telcom In a world where smart technologies determine our everyday life more and more, it is increasingly important to ensure global connectivity through wireless communication. This is where we, LS telcom AG, come into play: We deliver technologies and services to national and international regulatory authorities, network operators and vertical markets. 5G and IoT thereby form a main focus, but Defense and Public safety play an important role, too. LS telcom is the global leader in spectrum efficiency. In line with the diversification and commercialization of radio technologies there has been a constant increase in demand for frequency spectrum and its commercial value. Our Smart Spectrum Solutions hereby offer not only a high quality but also numerous designing, planning, management and monitoring options. Spectrum users in over 100 countries rely on our experts and products for efficient spectrum use. With around 235 employees in 15 subsidiaries worldwide we provide not only excellent products and services, but also a high number of diverse (online) trainings.

Aetha Consulting

Aetha Consulting Aetha Consulting provides strategic advice to the telecommunications industry and specialises in undertaking rigorous data-driven quantitative assessments to help businesses, regulators and policy makers make major strategic and regulatory decisions. We work with our clients to develop creative and sustainable solutions to the challenges facing them in a constantly changing environment. Aetha helps operators and regulators to analyse the opportunities and threats arising out of changes (whether real or proposed) in their radio spectrum holdings. Throughout the recent unprecedented growth of wireless services, Aetha’s staff have been at the forefront of spectrum policy. Our consultants have assisted regulators to award spectrum and develop regulatory frameworks, including supporting the European Commission to tackle issues such as spectrum trading and the digital dividend. We also support operators to understand their spectrum needs, value spectrum and bid in auctions. Each year we support around 10 bidders in spectrum auctions – a total of over 120 award processes between mid-2011 and 2023 across all regions of the world. Our technical knowledge, combined with our rigorous valuation modelling approach, ensures that our clients are comprehensively prepared for auctions.

NERA

NERA NERA Economic Consulting is a global firm of experts dedicated to applying economic, finance, and quantitative principles to complex business and legal challenges. For half a century, NERA’s economists have been creating strategies, studies, reports, expert testimony, and policy recommendations for government authorities and the world’s leading law firms and corporations. We bring academic rigor, objectivity, and real world industry experience to bear on issues arising from competition, regulation, public policy, strategy, finance, and litigation. NERA’s clients value our ability to apply and communicate state-of-the-art approaches clearly and convincingly, our commitment to deliver unbiased findings, and our reputation for quality and independence. Our clients rely on the integrity and skills of our unparalleled team of economists and other experts backed by the resources and reliability of one of the world’s largest economic consultancies. With its main office in New York City, NERA serves clients from more than 25 offices across North America, Europe, and Asia Pacific.

Renate Nikolay, Deputy Director General, DG CNECT, European Commission

Renate Nikolay, Deputy Director General, DG CNECT, European Commission Renate Nikolay is deputy director general at DG Connect. Before that, she was head of cabinet of Vera Jourova, the European commissioner for justice, consumers and gender equality. Before that, she led the Unit of interinstitutional and international relations in DG Justice between 2011 and 2014. She has also been an advisor in the cabinet of the first High Representative and Vice President Catherine Ashton where she led on the relations with the European Parliament in setting up the European External Action Service (EEAS) and on relations with Asia, in particular China. Before that, she was a member of the cabinet of Trade Commissioners Peter Mandelson and Catherine Ashton from 2004 to 2009. She started her career in the European Commission in the department for trade in November 2003 dealing with the accession negotiations of Vietnam to the World Trade Organisation and with the trade policy committee with the member states. She has also been a diplomat in the German Permanent Representation in Brussels and worked as private secretary to the German G8 sherpa in the German Ministry of Economics. Nikolay holds an M.A. as a Fulbright Scholar in Washington DC and a B.A. in law from the Free University in Berlin.

Aleksander Soltysik, Chair, Working Party, Telecommunications and Information Society, EU Council & Chairman, RSPG

Aleksander Soltysik, Chair, Working Party, Telecommunications and Information Society, EU Council & Chairman, RSPG ALEKSANDER SOŁTYSIK is an attaché for the telecommunication sector in the Permanent Representation of Poland to the European Union and represents Ministry of Digital Affairs in the Council of the European Union. The main responsibilities are matters regarding radio spectrum, gigabit infrastructure, artificial intelligence and Digital Decade. Currently he is the Chair of the Radio Spectrum Policy Group – a high-level advisory group that assists the European Commission in the development of radio spectrum policy. He is also an outgoing co-rapporteur of the RSPG Working Group on Peer Review and Member State cooperation on authorizations and awards, which is responsible for annual reports on the implementation of the art. 35 of the European Electronic Communications Code. Aleksander was the Head of International Telecommunication Unit at the Ministry of Digital Affair, engaged in the International Telecommunication Union’s and CEPT matters, mainly focusing on the preparations for the World Radiocommunication Conferences. He was a Kosciuszko Foundation scholar at the Hoover Institution, Stanford University and hold a PhD degree from the Jagiellonian University in Cracow.

Gilles Brégant, CEO, ANFR, France

Gilles Brégant, CEO, ANFR, France Born in Chambéry (France) in 1963, Gilles Brégant graduated from Ecole Polytechnique (1986) then from Telecom ParisTech (1988). Following a 7-year-career at France Telecom research center, Gilles Brégant led the transition project from “Minitel” electronic directory to its companion website, www.pagesjaunes.fr. He was then appointed technical adviser to the Minister in charge of Research (1996-1997). He had to coordinate international projects and themes in relation to information technology. He then worked for the department of trade and industry as deputy director in charge of Prospective.

He was appointed secretary general of the ministerial task force “Digital Economy” (2001-2005). He was then appointed Technical Director of Conseil supérieur de l’audiovisuel (the French Media Regulator) in 2005.

Gilles Brégant has been the CEO of ANFR since 2011. He was elected President of RSPG in November 2011.

Kostas Masselos, President, EETT, Greece

Kostas Masselos, President, EETT, Greece Professor Konstantinos Masselos has been appointed as the President of the Hellenic Telecommunications & Post Commission (EETT) in February 2018.

He has been elected as President of the Body of European Regulators for Electronic Communications (BEREC) for 2023 and also, Vice-President for 2022 and 2024. Moreover, he served as Vice-President of BEREC in 2019.

He is Professor in the Department of Informatics and Telecommunications of the University of Peloponnese and he served as Rector of the above University during the period 2012-2017. From 2005 to 2008, he was Lecturer in the Department of Electrical and Electronic Engineering at the Imperial College London. Also, during the period 2010-2016 he was an Honorary Lecturer in the same Department.

During the period 2001-2004, he worked in the electronic communications industry. Since 2005 he has been collaborating as an expert with various units of the European Commission. Also, he was a member of the Scientific Committee of the European Cooperation in Science and Technology (COST) from 2015 to 2017.

Alex Kuehn, Head of Section – International & National Spectrum Management, BNetzA

Alex Kuehn, Head of Section – International & National Spectrum Management, BNetzA After a state exam in law at the University of Osnabrück, Mr Kühn has been working since 1998 in the area of legal internship (e.g. at Regional Court) of the Federal Network Agency Germany; changing to National and International Spectrum Regulation on different levels in 2005. Nowadays, he is the Deputy Head of Section for International Affairs and Utilization Concepts. His responsibilities cover strategic frequency utilization concepts and the transposition of those to the international level of CEPT, EU and ITU. Doing this and having been active in the preparation of three WRC’s, on national and on CEPT CPG level, Mr Kühn participated in a number of international Groups, also as Head of the German Delegation. He has also chaired several groups and subgroups in the ITU and CEPT. Since 2005, he has been responsible for the German preparation of the WRC’s and served as CEPT CPG Vice Chairman from 2010 to 2013. Mr Kühn was appointed Chairman of CPG in June 2013.

Julia Inmaculada Criado Casado, Vice Chair, RSPG & Head of Radioelectric Spectrum Planning, Ministry for Digital Transformation and Civil Service, Spain

Julia Inmaculada Criado Casado, Vice Chair, RSPG & Head of Radioelectric Spectrum Planning, Ministry for Digital Transformation and Civil Service, Spain More information available on LinkedIn.

Chris Woolford, Director, International Spectrum Policy, Ofcom

Chris Woolford, Director, International Spectrum Policy, Ofcom Chris Woolford is Ofcom’s Director of International Spectrum Policy where his responsibilities cover the UK’s international spectrum interests, especially in relation to the ITU, CEPT and EU. He is a member of Ofcom’s Spectrum Executive Team and Strategy Steering Group.

Chris is active in various European spectrum committees and currently represents the UK on the Radio Spectrum Policy Group (RSPG). He has closely engaged for the UK on a number of key European and international spectrum initiatives and led the UK delegations to WRC-15 and WRC-12.

Before joining Ofcom, Chris worked in various UK Government Departments, including 6 years at Oftel, where he worked on different aspects of telecommunications regulation. Chris has a degree in mathematics and statistics from Manchester University.

Heidi Himmanen, Chief Adviser, Finnish Transport and Communications Agency (TRAFICOM)

Heidi Himmanen, Chief Adviser, Finnish Transport and Communications Agency (TRAFICOM) Dr. Heidi Himmanen is a Chief Adviser at the Finnish Transport and Communications Agency Traficom. Her tasks include promoting the uptake of wireless communications, especially 5G, in different sectors, such as transport, cities, and industry. The work includes supporting R&D and innovation and bridging the needs of the spectrum users with the development work in spectrum management. Heidi has previously worked as Head of Spectrum Supervision and Head of Radio Networks Unit at Finnish Communications Regulatory Authority (today Traficom).

She holds a D.Sc. (Tech.) degree in Telecommunications Engineering from the University of Turku, Finland, and an M.Sc. (Tech.) degree in Telecommunications Engineering from Helsinki University of Technology (today Aalto University), Finland.

Natalia Vicente, Vice President, Public Affairs, GSOA

Natalia Vicente, Vice President, Public Affairs, GSOA Natalia Vicente is the VP of Public Affairs at GSOA where she works closely with the Secretary General and the CEOs of ESOA Member companies to drive forward high-level advocacy for the satellite communications sector. Specifically, Natalia focuses on the Development Agenda working with international organisations to ensure nation states understand the value of leveraging available satellite communications services to bridge digital, education and health divides in their countries.

Natalia is also a Board Member of the European Internet Forum where she represents ESOA in front of Members of the European Parliament. Natalia has over a decade of experience in the digital sector, focusing on public policy, government relations and building international partnerships.

Before joining ESOA, Natalia worked for the European Telecommunications Network Operator’s (ETNO) working on public and regulatory affairs. Prior to that, she worked for Telefonica, Telecom Italia and TagTagCity, where she was one of the first employees involved in establishing a start-up venture providing mobile solutions to municipalities and local businesses in Belgium.

Natalia is a qualified lawyer with an LLM from the University Autonoma of Madrid and holds a Master of Business Administration specialised in Marketing. She is a Spanish national, lives in Brussels and speaks 4 languages.

Alex Epshteyn, Head, International WRC Spectrum Strategy, Amazon

Alex Epshteyn, Head, International WRC Spectrum Strategy, Amazon Electrical engineer with expertise in satellite and terrestrial radio communications technologies. Skilled in directing technical engineering examinations on spectrum management issues and electromagnetic compatibility of communications systems. Author of many international technical documents and position papers.

Experienced in international and domestic radio frequency spectrum management committees, policy negotiations and policy decision making.

Proven ability to provide assistance and advice on radiocommunication issues that may have national or international impact on communication systems.

Martha Suarez, President, DSA

Martha Suarez, President, DSA Martha Suarez was born in Bucaramanga, Colombia. She received her degree as Electronics Engineer from the Universidad Industrial de Santander in 2004. During her undergraduate studies, she participated in an exchange program with the Ecole Superieure Chimie Physique Electronique de Lyon, France, in 2001. She received her master’s degree in high frequency communication systems from the University of Marne-la-Vallee, France, in 2006 and her Ph.D. degree from the University Paris-Est in 2009. She joined the department of Telecommunications and Signal Processing at the École Supérieure d’Ingénieurs en Électronique et Électrotechnique de Paris ESIEE and the Esycom Research Center, where she worked on wireless transmitter architectures. In 2011, she was awarded with a Marie Curie Fellowship and worked at the Instytut Technologii Elektronowej ITE in Poland for the Partnership for Cognitive Radio (Par4CR) European Project. Her research interests were in the areas of wireless system architectures and the design of high performance Radio Frequency (RF) transceivers.

In 2013, she joined the National Spectrum Agency in Colombia, ANE, where she worked as Senior Adviser to the General Director and supported the international activities of the Agency. Afterwards, in December 2015, she became the General Director of ANE and continued promoting the efficient use of the Spectrum and the mobile broadband connectivity in Colombia.

Since the 1st of May 2019, Martha Suarez has been the President of the Dynamic Spectrum Alliance DSA, a global organization advocating for laws and regulations that will lead to more efficient and effective spectrum utilization, which is essential to addressing key worldwide social and economic challenges.

Daniel Gueorguiev, Senior Advisor, Government Relations and Policy, Vodafone

Daniel Gueorguiev, Senior Advisor, Government Relations and Policy, Vodafone More information will be available shortly.

Mindel De La Torre, Head of Global Regulatory Affairs, Skylo

Mindel De La Torre, Head of Global Regulatory Affairs, Skylo Mindel De La Torre recently joined Skylo Technologies, the pioneer in ‘direct-to-device’ Non-Terrestrial Network (NTN) communications, as Head of Global Regulatory Affairs. Mindel’s deep industry knowledge includes experience as the Chief Regulatory and International Strategy Officer at Omnispace as well as having been the Chief of the International Bureau at the Federal Communications Commission. Her expertise includes licensing, spectrum policy, and managing regulatory approvals in key markets worldwide. Mindel is helping Skylo expand into new markets and is leading the company’s global regulatory strategy.

She has had leadership positions on U.S. delegations and at ITU conferences, such as World Radiocommunication Conferences, World Telecommunication Development Conferences, and Plenipotentiary Conferences, where she was Vice-Chair of the U.S. delegations to these global conferences. She has actively participated in regional telecommunications organizations, such as CITEL, APEC, and the ATU.

Mindel received her juris doctorate from the University of Texas and holds her bachelor’s degree from Vanderbilt University.

Olivier Beaujard, Chairman of the Board & the Regulatory Group, LoRa Alliance

Olivier Beaujard, Chairman of the Board & the Regulatory Group, LoRa Alliance Olivier Beaujard, is Senior Director in charge of the LoRa Ecosystem at Semtech since 2017.

He is the Chair of the Board of Directors the LoRa Alliance where he is Semtech primary representative – he is also holding several leadership roles (Regulatory Chair, Roadmap Chair).

Before joining Semtech he spent 18 years in the wireless M2M / IoT industry, he did hold various roles in Marketing and Business Development at Sierra Wireless.

In early 1999, he joined Wavecom (acquired by Sierra Wireless in 2009) where he was in charge of Product Marketing where he did start the Marketing activity from scratch.

Prior to Wavecom, Mr Beaujard had an international Sales experience in the value-added services platforms for telecommunications networks at Ferma (now e-Serv Global).

Mr. Beaujard worked also in the smart card industry for Gemalto where he was responsible of the GSM standardization at ETSI/3GPP.

Mr Beaujard graduated from the National Polytechnic Institute of Grenoble (INPG – ENSERG) with an electronics and telecommunications engineer diploma. He also holds an MBA of ESSEC business school with honours.

Erika Tejedor, Vice President, Spectrum Regulations, Ericsson

Erika Tejedor, Vice President, Spectrum Regulations, Ericsson Erika Tejedor is Vice President of spectrum regulations at Ericsson and focuses on securing globally harmonized spectrum availability and favorable regulations for mobile technologies across different business sectors. With over 15 years of experience in the mobile industry, she has worked across research, product development, 3GPP and ETSI standardization, ITU-R, spectrum regulations, industry partnership and government relations.

Follow Erika on LinkedIn.

Jaume Pujol, Head of the Policy Working Group, Broadcast Network Europe (BNE)

Jaume Pujol, Head of the Policy Working Group, Broadcast Network Europe (BNE) More information will be available shortly.

Alan Norman, Director, Public Policy, Meta

Alan Norman, Director, Public Policy, Meta Alan Norman joined Meta’s connectivity policy team in 2016 and actively supports Meta’s Spectrum and Connectivity initiatives. Alan is a long-time advocate for improved broadband and internet access, shared infrastructure, and spectrum for next generation technologies. Recently Alan has been engaged on spectrum for AR/VR, Wi-Fi, UWB and 5G with a focus on enabling the Metaverse.

Alan holds a BS in Mathematical Sciences from Stanford University and an MS in Management from Stanford’s Graduate School of Business where he was a Sloan Fellow.

Detlef Fuehrer, Director Spectrum Management and Regulatory Affairs EMEA, HPE

Detlef Fuehrer, Director Spectrum Management and Regulatory Affairs EMEA, HPE Detlef Fuehrer is the Senior Manager, Spectrum Management and Regulatory Affairs, EMEA in the CTO Office at Aruba, a Hewlett Packard Enterprise company. His main responsibility is to set and drive HPE’s legislative & regulatory priorities for the radio spectrum in EMEA and to execute all aspects of HPE’s EMEA strategy.

Prior to Aruba, Detlef managed the Spectrum Engineering activities of the European Commission’s Joint Research Centre where he established the Radio Spectrum Lab. Holding a diploma in Electronics Engineering from Dortmund University, he worked in the semiconductor industry for almost 20 years, predominantly in the communications domain, at Alcatel, Texas Instruments, and Hitachi Electronic Components. Detlef authored the first German-language expert book on ADSL and published numerous studies on spectrum sharing and wireless coexistence.

Julia Inmaculada Criado Casado, Vice Chair, RSPG

Julia Inmaculada Criado Casado, Vice Chair, RSPG More information will be available shortly

Jonas Wessel, Director, Spectrum Management, Swedish Post & Telecom Agency - PTS

Jonas Wessel, Director, Spectrum Management, Swedish Post & Telecom Agency - PTS Jonas Wessel is Director of the Spectrum Department at the Swedish Post and Telecom Agency (PTS).

He was also Chair of the Radio Spectrum Policy Group (RSPG) for the 2018-2019 period. The RSPG is a high-level advisory group that assists the European Commission in the development of radio spectrum policy. Jonas holds a MSC from the Royal Institute of Technology (KTH) in Industrial Engineering and Management. Jonas started his professional career as a strategy consultant, working mainly with business development in the telecoms and IT-sector.

In 2003, he joined the PTS as advisor on radio spectrum policy issues. After several positions within the Agency, including responsibility for auctions, he was assigned Director of the Spectrum Department in 2014. Jonas has been one of the driving forces behind the transformation of spectrum management in Sweden and has also been working with these issues internationally, mainly through the RSPG where he has been a delegate since 2004. He was Vice Chairman of the RSPG for the 2016-2017 period.

ALEKSANDER SOŁTYSIK is an attaché for the telecommunication sector in the Permanent Representation of Poland to the European Union and represents Ministry of Digital Affairs in the Council of the European Union. The main responsibilities are matters regarding radio spectrum, gigabit infrastructure, artificial intelligence and Digital Decade. Currently he is the Chair of the Radio Spectrum Policy Group – a high-level advisory group that assists the European Commission in the development of radio spectrum policy. He is also an outgoing co-rapporteur of the RSPG Working Group on Peer Review and Member State cooperation on authorizations and awards, which is responsible for annual reports on the implementation of the art. 35 of the European Electronic Communications Code. Aleksander was the Head of International Telecommunication Unit at the Ministry of Digital Affair, engaged in the International Telecommunication Union’s and CEPT matters, mainly focusing on the preparations for the World Radiocommunication Conferences. He was a Kosciuszko Foundation scholar at the Hoover Institution, Stanford University and hold a PhD degree from the Jagiellonian University in Cracow.

The European Commission’s Digital Networks Act (DNA), expected to be released in Q4 2025, aims to propose solutions to improve market incentives to build the digital networks of the future, reduce burden and compliance costs, and improve digital connectivity for end-users by creating an integrated single market for connectivity and a more coordinated EU spectrum policy. Spectrum policy is set to be a major focus, with a likely push for greater harmonisation and coordination across member states, alongside an emphasis on long-term spectrum licenses to provide regulatory stability and encourage investment. While these measures could lead to more standardised and efficient spectrum use, aligning national policies remains complex due to differing national circumstances and telecom market structures. This session will explore the expected spectrum policy proposals within the DNA, assessing how they may build upon the existing regulatory framework to optimise spectrum value. It will also assess the potential impact on industry stakeholders and explore the implications for the roles and responsibilities of European policymakers and national authorities, respectively. It will look at the extent to which reform is needed in European spectrum policy and at how this can be best approached as part of the Digital Networks Act (DNA) to ensure a well-balanced and effective policy framework that supports Europe’s broader digital goals.

An engineer with broad experience in the telecoms and technology sectors, Andy has a particular interest in spectrum (auctions and valuation) and the impact of new technology (5G, AI, IoT and Big Data). He brings a deep understanding of both the industry and regulatory perspectives around the world through his role as Head of Policy for the GSMA and as Director of Spectrum Policy at Ofcom.

Andy spent 12 years at Vodafone, where he held various senior product development and corporate strategy roles. As Head of Spectrum, he was responsible for managing spectrum policy and auctions across the Vodafone Group. He led over twenty spectrum auctions around the world (including Turkey, Italy, Germany, India, Spain, Italy, Greece, Australia, Romania, NL and UK) from strategy/business case development to Plc. Board level sign-off and in-country implementation.

He was formerly a management consultant, has launched an internet payments and encryption company and worked as a research scientist at Sharp Laboratories of Europe and Sony Corporation, based in Japan. He has a doctorate in Engineering Science from Oxford University and an MBA. He is a frequent invited speaker at international conferences.

Gerasimos Sofianatos is the newly appointed Head of Unit of Connect B5, Radio Spectrum Policy Unit. Previously, he was Deputy Head of DG Connect Unit Connect B5, “Investment in high-capacity networks”. He has been working for the Commission since 2011, in different positions in DG Connect, in Directorate B, dealing with the policy and implementation of the EU Regulatory Framework for Electronic Communications. Gerasimos led the team monitoring and implementing EU law and in particular the European Electronic Communications Code, a piece of legislation in the drafting and negotiation of which he was actively involved. Prior to joining the Commission, Gerasimos worked as legal officer at the Cypriot National Regulatory Authority for Electronic Communications (OCECPR). Before joining the Commission, he was a Member of the Athens Bar Association and practiced competition law. He holds a Masters degree in Business Law and a PhD in competition law at the Paris 1- Sorbonne University. He holds a law degree from the Aristotle University of Thessaloniki and a post-graduate degree in Economics for Competition law from the King’s College London. Gerasimos is of Greek nationality and speaks Greek, English, and French.

Professor Konstantinos Masselos has been appointed as the President of the Hellenic Telecommunications & Post Commission (EETT) in February 2018.

He has been elected as President of the Body of European Regulators for Electronic Communications (BEREC) for 2023 and also, Vice-President for 2022 and 2024. Moreover, he served as Vice-President of BEREC in 2019.

He is Professor in the Department of Informatics and Telecommunications of the University of Peloponnese and he served as Rector of the above University during the period 2012-2017. From 2005 to 2008, he was Lecturer in the Department of Electrical and Electronic Engineering at the Imperial College London. Also, during the period 2010-2016 he was an Honorary Lecturer in the same Department.

During the period 2001-2004, he worked in the electronic communications industry. Since 2005 he has been collaborating as an expert with various units of the European Commission. Also, he was a member of the Scientific Committee of the European Cooperation in Science and Technology (COST) from 2015 to 2017.

Javier Domínguez is Head of Regulation in Telefonica’s corporate unit. He works closely with business and technical units, academia and relevant policymakers to develop the company’s awareness and advocacy on regulatory issues, with a special focus on spectrum policy. He is also Chairman of the GSMA FREQ group.

Javier has an Economics and Legal background and has worked in Telefonica at local and corporate level in different regulatory roles. He has participated in spectrum auctions and spectrum policy discussions in several European countries since 2011, and he has also been engaged on a wide range of other telecom and digital policy issues. Prior to joining Telefónica he worked for Ericsson for 5 years.

Natalia Vicente is the VP of Public Affairs at GSOA where she works closely with the Secretary General and the CEOs of ESOA Member companies to drive forward high-level advocacy for the satellite communications sector. Specifically, Natalia focuses on the Development Agenda working with international organisations to ensure nation states understand the value of leveraging available satellite communications services to bridge digital, education and health divides in their countries.

Natalia is also a Board Member of the European Internet Forum where she represents ESOA in front of Members of the European Parliament. Natalia has over a decade of experience in the digital sector, focusing on public policy, government relations and building international partnerships.

Before joining ESOA, Natalia worked for the European Telecommunications Network Operator’s (ETNO) working on public and regulatory affairs. Prior to that, she worked for Telefonica, Telecom Italia and TagTagCity, where she was one of the first employees involved in establishing a start-up venture providing mobile solutions to municipalities and local businesses in Belgium.

Natalia is a qualified lawyer with an LLM from the University Autonoma of Madrid and holds a Master of Business Administration specialised in Marketing. She is a Spanish national, lives in Brussels and speaks 4 languages.

Luigi Ardito is currently working as Director of government affairs for Europe, Middle East and North Africa at Qualcomm and drives the Qualcomm spectrum and regulatory policy agenda in Europe and MENA dealing with various government entities and industry organizations.

Prior to joining Qualcomm, Luigi worked for over a decade at Sony Corporation both in Japan and in the UK. Luigi also gained professional experience at France Telecom and at the Italian Public Broadcaster RAI.

Luigi has extensive experience in the Media and Telecom industry as well as the Semiconductor Industry gained through his assignments at Qualcomm, Sony, France Telecom and RAI. He holds an Electronic Engineering Degree gained at the Politecnico di Torino in Italy and a Master of Business Administration gained at the Henley Management College in the UK.

Vincent Sneed is Senior EU Policy Adviser at the European Broadcasting Union, the world’s leading alliance of public service media (PSM). He has worked there since the beginning of 2019. Previously, he worked for the Association of European Radios (AER) between 2006 and 2019.

At the EBU, he covers EU policy related to copyright and distribution, including spectrum-related rules.

He has worked on the European Electronic Communications Code, the UHF Decision, the preparation to the World Radiocommunication Conference, the Radio Spectrum Policy Programme, the DSM Copyright Directive, the NetCab Directive, the Collective Rights’ Management Directive, and other spectrum management, copyright, advertising and media-related dossiers.

He studied law in France, Spain and the Netherlands, and speaks French, English, Italian and Spanish.

Discussions across Europe are continuing on the future of the upper 6 GHz band (6425-7125 MHz), with CEPT being tasked by the European Commission to study the feasibility of a hybrid/shared approach. This session will look at the extent to which a hybrid approach in this way can be a viable ‘win-win’ solution and the challenges and obstacles that potentially stand in the way. With RSPG due to publish their recommendations on the future of the band just a day before this conference, it will look at the findings and outcomes of this and at how it fits with the broader discussions that are taking place at a European and member state level. It will discuss the factors that are likely to ultimately decide the approach that Europe takes to this key spectrum in the long term, and depending on whether a licenced, unlicenced or hybrid approach is selected, the measures that will then be required to ensure the long-term future of all the key stakeholders involved.

Amit specialises in advising on complex wireless transactions and strategy projects, including supporting mobile operators with spectrum valuation and regulators with the development and implementation of spectrum policy.

Amit has over 25 years of experience advising fixed and mobile operators, regulators/government bodies, financial institutions and equipment manufacturers on commercial, technical and regulatory issues. He has supported several multi-billion dollar M&A and debt financing transactions and has led numerous high-profile studies in the area of radio spectrum policy. Amit brings a global perspective to his work, having undertaken projects for clients in Europe, Asia, the Middle East, Africa, and the Americas.

Amit holds an M.Sc. in Radio Frequency and Communications Engineering from the University of Bradford, UK and an M.B.A. from the University of Warwick, UK.

Born in Chambéry (France) in 1963, Gilles Brégant graduated from Ecole Polytechnique (1986) then from Telecom ParisTech (1988). Following a 7-year-career at France Telecom research center, Gilles Brégant led the transition project from “Minitel” electronic directory to its companion website, www.pagesjaunes.fr. He was then appointed technical adviser to the Minister in charge of Research (1996-1997). He had to coordinate international projects and themes in relation to information technology. He then worked for the department of trade and industry as deputy director in charge of Prospective.

He was appointed secretary general of the ministerial task force “Digital Economy” (2001-2005). He was then appointed Technical Director of Conseil supérieur de l’audiovisuel (the French Media Regulator) in 2005.

Gilles Brégant has been the CEO of ANFR since 2011. He was elected President of RSPG in November 2011.

Martin is Director of Spectrum Policy in the of the Spectrum Group of Ofcom (UK). He is also Chairman of ITU-R Study Group 5, the group responsible for all terrestrial radio frequency services. Martin is an expert in international and domestic spectrum regulation; specialising in spectrum policy, interference analysis and RF performance. He has 20 years’ experience in spectrum management at the UK communications regulator, Ofcom, and its predecessor, the Radiocommunications Agency.

Luiz works as Spectrum Engagement Director at the GSMA towards the global and regional advance of spectrum issues such as licensing, roadmaps, pricing, sharing, synchronisation, coverage and 5G international advocacy. Luiz leads the GSMA campaign to gain access to harmonised spectrum for mobile broadband, working with a team of regional experts for the delivering of spectrum policy and licensing best practice to key markets across the globe.

Luiz joined the GSMA in 2018 as Policy and Future Spectrum Project Manager to lead the delivery of the World Radiocommunication Conference 2019 (WRC-19) campaign and coordinate the Future Spectrum executive group. Previously, Luiz has worked in the mobile industry for almost 10 years, lastly as Spectrum Specialist at TIM Brasil in Regulatory Intelligence, where also had been an intern, analyst, consultant and senior consultant. He has acted as the Strategic Leader for the implementation of 700 MHz LTE and Digital TV Migration in Brazil, and as a board member in two associations: ABR Telecom (wholesale and data integration) and Seja Digital – EAD (700 MHz).

Luiz holds an M.B.A. at the State University of Rio de Janeiro and a Masters (MSc) in International Management at the Universite D’Angers, France. He has graduated in Business Administration, splitting his studies between the Catholic University of Rio de Janeiro (PUC-Rio) and the Jon M. Huntsman School of Business at Utah State, with an extension diploma in International Management at the University of Victoria, Canada.

Alex Roytblat is Vice President of Worldwide Regulatory Affairs, where he is responsible for managing and overseeing all regulatory matters and compliance issues related to the Wi-Fi ecosystem. In his role, Alex works with Wi-Fi Alliance members, directors and executives to advance policy priorities with policymakers, regulators and other stakeholders.

With more than 25 years of experience in telecom regulations, Alex is an internationally recognized expert with a deep understanding of the regulatory landscape. Prior to joining Wi-Fi Alliance, Alex served at the United States Federal Communications Commission, where he was involved in all phases of domestic and international radio spectrum management processes.

Previously, Alex held technical roles at Stanford Telecommunications and Booz Allen & Hamilton. He holds a Master of Science in Communications Networks from Johns Hopkins University and a Bachelor of Science in Electrical Engineering (Eta Kappa Nu) from George Mason University.

Detlef Fuehrer is the Senior Manager, Spectrum Management and Regulatory Affairs, EMEA in the CTO Office at Aruba, a Hewlett Packard Enterprise company. His main responsibility is to set and drive HPE’s legislative & regulatory priorities for the radio spectrum in EMEA and to execute all aspects of HPE’s EMEA strategy.

Prior to Aruba, Detlef managed the Spectrum Engineering activities of the European Commission’s Joint Research Centre where he established the Radio Spectrum Lab. Holding a diploma in Electronics Engineering from Dortmund University, he worked in the semiconductor industry for almost 20 years, predominantly in the communications domain, at Alcatel, Texas Instruments, and Hitachi Electronic Components. Detlef authored the first German-language expert book on ADSL and published numerous studies on spectrum sharing and wireless coexistence.

Erika Tejedor is Vice President of spectrum regulations at Ericsson and focuses on securing globally harmonized spectrum availability and favorable regulations for mobile technologies across different business sectors. With over 15 years of experience in the mobile industry, she has worked across research, product development, 3GPP and ETSI standardization, ITU-R, spectrum regulations, industry partnership and government relations.

Follow Erika on LinkedIn.

Mid-band frequencies have long been seen as a crucial part of the spectrum portfolio for a number of key users. In Europe, we are now at the stage where the majority of frequencies in the sub-6GHz midband frequency ranges have been allocated and brought to market. A number of key non-terrestrial and terrestrial users are seen across the bands, and in addition, the 3.8GHz to 4.2GHz band has been harmonised to provide spectrum for localised networks, offering connectivity to key vertical sectors. With these mid-band frequencies offering some of the most valuable bandwidth both for IMT and other users, it is vital that the bandwidth they contain is being used to its maximum potential. The session will look at the extent to which this is currently happening, at the way in which the technology and device ecosystem is developing across different bands, and at whether there are options that could be explored to further increase efficiency and value of these hugely important frequencies for the benefit of all.

Julia is a Consultant based in Cambridge. During her time at Analysys Mason, she has developed expertise in desktop research, quantitative and qualitative data analysis, and developing conclusions and recommendations. She has a diverse portfolio of project experience working for a range of clients, including government departments, vendors, operators, regulators, and international finance institutions.

Her recent experience includes a series of research projects on licensed and unlicensed spectrum availability, assignments, regulation, and key market potential – with a particular focus on 5G; a project modeling the cost and impact of various factors on different 5G use cases in a developed nation; support for the development of a detailed financial model for an Asian–Pacific operator, including providing evidence and responses to the regulator’s questions; and a publication on the success of the internet – requiring computational analysis of open-source data, interviews with key stakeholders, and its presentation at a series of conferences.

Julia holds an MEng in Chemical Engineering from the University of Cambridge.

Position

Head of Sector ‘Wireless Broadband’ at the Radio Spectrum Policy Unit of DG CONNECT, European Commission

Branimir is responsible for the development and implementation of EU-level spectrum policy for wireless broadband and beyond 5G as well as the integration of research and innovation policies. Specific topics include the EU-level spectrum roadmap, harmonised spectrum allocation, coordination of authorisation practice, spectrum management for vertical sectors, international cooperation.

Past

Branimir has been working for the European Commission since 2008.

He started his professional career in 1995 at the Vodafone Chair for Mobile Communications Systems at the Dresden University, Germany. From 2000 until 2008 he worked with the companies Philips, Qimonda and Signalion (later National Instruments) in Germany in the area of wireless equipment design, manufacturing and marketing. He has made contributions to Wi-Fi standardisation.

Branimir has a PhD degree in mobile communications from the Dresden University.

After a state exam in law at the University of Osnabrück, Mr Kühn has been working since 1998 in the area of legal internship (e.g. at Regional Court) of the Federal Network Agency Germany; changing to National and International Spectrum Regulation on different levels in 2005. Nowadays, he is the Deputy Head of Section for International Affairs and Utilization Concepts. His responsibilities cover strategic frequency utilization concepts and the transposition of those to the international level of CEPT, EU and ITU. Doing this and having been active in the preparation of three WRC’s, on national and on CEPT CPG level, Mr Kühn participated in a number of international Groups, also as Head of the German Delegation. He has also chaired several groups and subgroups in the ITU and CEPT. Since 2005, he has been responsible for the German preparation of the WRC’s and served as CEPT CPG Vice Chairman from 2010 to 2013. Mr Kühn was appointed Chairman of CPG in June 2013.

Matthew Kellison is the Director General of Spectrum Policy at Innovation, Science, and Economic Development (ISED) Canada. In this role he is responsible for ISED’s overall planning and allocation of wireless spectrum, as well as administering spectrum auctions. Prior to joining ISED, Matthew held senior positions at Canada’s Competition Bureau and its Patented Medicine Prices Review Board, and has extensive experience in price regulation, marketplace policy, and antitrust law. He holds a Master’s degree in Economics from Queen’s University.

Mr Jochum is a Vice President of Spectrum policy and Projects at Deutsche Telekom AG (DT). Jan joined DT in 2009 and has worked in the regulatory sector since 2014. Prior to joining DT he was working in different projects in Europe for a management consultancy firm. Jan holds a Master of Arts in Political Sciences from the University of Bonn, Germany.

The 470-694 MHz (sub-700MHz) band is the core band for DTT broadcast services and for audio Programme Making and Special Events (PMSE). Both at a WRC and ITU level, decisions have been taken to protect broadcast services as the exclusive primary user in the band until at least 2030, but discussions have now turned to look at what then comes next – to 2030 and beyond. This session will discuss exactly that. Following a recent public consultation and workshop held on the issues, RSPG are launching their draft report ‘the future usage of sub – 700 MHz bands in the EU’ on the day before this event, and against this backdrop, this session will look at the long-term future of these key frequencies and of the key stakeholders that utilise them.

Andreas holds a diploma in Electrical Engineering of University of Patras, Greece , and an MSc and a PhD in Satellite and Antennas for Personal Wireless Communications of the University of Surrey, UK.

He is working as a spectrum engineer for the Greek NRA (EETT) for the last 22 years. Currently he is the Head of the Spectrum Monitoring Planning Department and Project Manager of the new Satellite Spectrum Monitoring Station of EETT. Previously was the Co-ordinator for Broadcasting Spectrum Monitoring in EETT.

Jonas Wessel is Director of the Resource Management Department at the Swedish Post and Telecom Agency (PTS). He is also Chair of the Radio Spectrum Policy Group (RSPG) for the 2018-2019 period. The RSPG is a high-level advisory group that assists the European Commission in the development of radio spectrum policy. JMr Wessel holds a MSC from the Royal Institute of Technology (KTH) in Industrial Engineering and Management. He started his professional career as a strategy consultant, working mainly with business development in the telecoms and IT-sector.

In 2003, Mr Jonas joined the PTS as advisor on radio spectrum policy issues. After several positions within the Agency, including responsibility for auctions, he was assigned Director of the Spectrum Department in 2014. Jonas has been one of the driving forces behind the transformation of spectrum management in Sweden and has also been working with these issues internationally, mainly through the RSPG where he has been a delegate since 2004. He was Vice Chairman of the RSPG for the 2016-2017 period.

Ulrich holds a diploma degree in Electrical Engineering of Technical University of Munich, Germany, and one in Industrial Engineering of Fernuniversität Hagen, Germany. Of his 30+ years of professional experience in Siemens, Nokia Siemens Networks, and Nokia, he spent 15+ years in R&D, business strategy, system architecture, and product management of mobile radio network systems covering GSM, EDGE, UMTS, Flash OFDM, WiMAX, LTE, and 5G. Since 2011, he is responsible for spectrum policy at Nokia within the Strategy & Technology organisation.

Ulrich is vice chair of the DIGITALEUROPE spectrum working group in Brussels and the BITKOM spectrum working group in Germany.

Vaughan is the Spectrum Policy and Standards Manager at Sennheiser electronic SE & Co. KG, the leading European manufacturer for professional audio solutions such as microphones, meeting solutions, streaming technologies and in-ear monitoring systems. Vaughan works with national and international spectrum regulatory bodies to ensure access to spectrum for existing and new wireless audio technologies (such as Wireless Multi-channel Audio Systems) used in Programme Making and Special Events (PMSE).

Prior to joining Sennheiser, Vaughan gained over 20 years of experience in spectrum policy and regulation as a Principal Spectrum Policy Manager at Ofcom (UK) where he initiated and delivered a range of spectrum policy objectives. He was responsible for spectrum policy for Private Mobile Radio, Emergency Services, Utilities, PMSE, TV White Space, Shared Access licensing and Dynamic Spectrum Access.

More information will be available shortly.

As connectivity demands continue to grow, spectrum sharing has become an increasingly important tool for optimizing limited resources. While Europe has traditionally taken a cautious approach compared to other regions, spectrum sharing is increasingly being seen across member states as a key strategy for maximising efficiency and meeting the needs of next-generation technologies. This session will explore how new regulatory approaches and innovative technological solutions are already shaping the landscape of spectrum sharing in Europe and explore how these developments could further accelerate shared solutions in the future. It will discuss the ongoing challenges associated with different sharing models, with a specific focus on mobile networks and the extent to which these can be part of a part of an efficient and scalable sharing solution. Finally, the discussion will assess the need for greater regional coordination and examine lessons from global best practices that could help shape Europe’s approach to spectrum sharing in the years ahead.

Richard Marsden specializes in market design, including auctions and trading, bidding strategy, and related competition, pricing, regulatory, and public policy issues. He applies this expertise to multiple industries, including broadcasting, energy, mobile telephony, procurement, radio spectrum, technology, and transport to help his clients create or participate in new marketplaces.

Over the last 20 years, Mr. Marsden has provided guidance to regulators, private companies, and law firms in more than 50 countries. His teams at NERA are particularly well known for their work on the design and implementation of high-value auctions and the development of effective bid strategies. To support this work, the team has developed a suite of software tools for running, simulating, and analyzing auctions.

In the communications sector, Mr. Marsden’s experience includes auction design and implementation, bid strategy advisory work, expert witness reports, and litigation support concerning spectrum allocation, spectrum pricing, spectrum valuation, and mobile market competition. He has advised clients on spectrum auction design and implementation for 4G and 5G mobile spectrum in Belgium, Mexico, Saudi Arabia, Singapore, and South Africa. Mr. Marsden has also provided bid strategy advice to mobile operators participating in auctions for 4G and 5G mobile frequencies in more than 30 countries, including spectrum auctions in Australia, Brazil, Canada, Germany, Spain, the UK, and the US. This work often includes developing or critiquing valuation models. He has also advised on auctions procuring subsidies for broadband rollout.

In the energy sector, Mr. Marsden has designed auctions for electricity interconnection capacity, offshore wind generation sites, and gas pipeline capacity. Additionally, he has advised energy companies participating in capacity markets and offshore wind auctions.

In the technology sector, Mr. Marsden has advised companies on the design of auctions for procurement processes, pricing of used products for resale, and regulatory processes for inducing competition in vertically integrated markets.

Mr. Marsden frequently presents and publishes on topics related to market design, auctions, the communications industry, and spectrum management. He has completed major studies for the GSMA on spectrum pricing and for the European Commission on the transfer of digital dividend spectrum from broadcast to mobile use and on spectrum trading and spectrum liberalization. He contributed a chapter to the Handbook of Spectrum Auction Design on combinatorial auctions and is the co-author of Broadband in Europe: How Brussels Can Wire the Information Society.

After his studies at TU Delft, Bram van den Ende (MSc EE) joined TNO in 1990 where he was engaged in electronic warfare and in tactical communications innovations for more than eight years. In that period he acted for a few years as advisor to the MOD on spectrum policy matters and joined the corresponding NATO advisory group. In 1998 switched to Siemens to enjoy the fast growing wireless access market at that time.

After 1,5 years he returned to TNO where he was active for about 20 years in the area of innovations in wireless communications and applications, in the role of project leader and consultant. Over that period, he developed and led a large number of applied research and consultancy projects for domestic and international governmental accounts as well as PPS projects with larger consortia. During that time he was also engaged in consultancy work on national spectrum policy matters.

One of the threads in his work was the topic of co-existence between satellite communications (DL) and terrestrial networks that was most manifest in the 3,5 GHz band between 2008 and 2023. In 2020 he turned to the RDI (formerly known as Agentschap Telecom) where he initiated with colleagues the DSMS project on dynamic sharing between satcom and terrestrial networks.

Since May 2023 he has a position as spectrum policy officer in the Digital Economy Directorate of the Ministry of Economic Affairs. His current main focus is on the 3,8-4,2 GHz and Upper 6 GHz bands. Bram participates in selected RSPG subgroups and is NL-delegate in the RSC.

Guillaume Mascot is in charge of Shure’s Global Regulatory Policy. His role involves strengthening Shure thought-leadership among public authorities, institutions, and regulatory bodies, while advocating alongside key players in the ecosystem for a sustainable content creative industry. As the demand for wireless audio equipment grows to fulfil the demand for more contents (films, theater, music, sports, worship, civic events, education,…) and the spectrum becomes scarcer, joint efforts are crucial to ensure long-term access to this limited resource. Guillaume’s role also considers future regulations related to cybersecurity and AI, which may impact Shure’s products.

Guillaume is covering the European Institutions, France as well as supporting the Asia-Pacific region and various Francophone regions around the world.

With nearly 20 years of leadership experience in government and public affairs within multinational telecommunications companies, Guillaume has a strong expertise and in-depth knowledge of the European and Asia-Pacific markets to the development of Shure’s institutional strategy.

Guillaume Mascot, 42, holds a Master’s degree in Political Science from the University of Lille (2004). He began his career at the European Commission before joining the Alcatel-Lucent group as Manager of European Affairs. After spending seven years at the headquarters in France, he was appointed to the position of Director of Public Affairs for the Asia-Pacific region in China, where he was responsible for government relations, successfully influencing political decisions and regulatory frameworks in support of business objectives. In 2016, following the merger and acquisition between Alcatel-Lucent and Nokia, Guillaume became Head of Government Relations for the APAC region (including India), with the mission of enabling Nokia to access the market and develop its business through the establishment of strategic partnerships and participation in high-level events (WEF, ITU, APT). He was also representing GSA (Global Supplier Association) in South East Asia.

More information will be available shortly.

Olivier Beaujard, is Senior Director in charge of the LoRa Ecosystem at Semtech since 2017.

He is the Chair of the Board of Directors the LoRa Alliance where he is Semtech primary representative – he is also holding several leadership roles (Regulatory Chair, Roadmap Chair).

Before joining Semtech he spent 18 years in the wireless M2M / IoT industry, he did hold various roles in Marketing and Business Development at Sierra Wireless.

In early 1999, he joined Wavecom (acquired by Sierra Wireless in 2009) where he was in charge of Product Marketing where he did start the Marketing activity from scratch.

Prior to Wavecom, Mr Beaujard had an international Sales experience in the value-added services platforms for telecommunications networks at Ferma (now e-Serv Global).

Mr. Beaujard worked also in the smart card industry for Gemalto where he was responsible of the GSM standardization at ETSI/3GPP.

Mr Beaujard graduated from the National Polytechnic Institute of Grenoble (INPG – ENSERG) with an electronics and telecommunications engineer diploma. He also holds an MBA of ESSEC business school with honours.

Martha Suarez was born in Bucaramanga, Colombia. She received her degree as Electronics Engineer from the Universidad Industrial de Santander in 2004. During her undergraduate studies, she participated in an exchange program with the Ecole Superieure Chimie Physique Electronique de Lyon, France, in 2001. She received her master’s degree in high frequency communication systems from the University of Marne-la-Vallee, France, in 2006 and her Ph.D. degree from the University Paris-Est in 2009. She joined the department of Telecommunications and Signal Processing at the École Supérieure d’Ingénieurs en Électronique et Électrotechnique de Paris ESIEE and the Esycom Research Center, where she worked on wireless transmitter architectures. In 2011, she was awarded with a Marie Curie Fellowship and worked at the Instytut Technologii Elektronowej ITE in Poland for the Partnership for Cognitive Radio (Par4CR) European Project. Her research interests were in the areas of wireless system architectures and the design of high performance Radio Frequency (RF) transceivers.

In 2013, she joined the National Spectrum Agency in Colombia, ANE, where she worked as Senior Adviser to the General Director and supported the international activities of the Agency. Afterwards, in December 2015, she became the General Director of ANE and continued promoting the efficient use of the Spectrum and the mobile broadband connectivity in Colombia.

Since the 1st of May 2019, Martha Suarez has been the President of the Dynamic Spectrum Alliance DSA, a global organization advocating for laws and regulations that will lead to more efficient and effective spectrum utilization, which is essential to addressing key worldwide social and economic challenges.

Stephen is a member of Vodafone’s Group Policy & Public Affairs team and has global responsibility for telecom network policy. This involves working with regional and national policymakers and regulators to create an environment that supports investment, innovation, and sustainable competition across fixed and mobile networks. He manages the company’s spectrum licensing activities across Europe and Africa, including all licence valuation, acquisition, and renewal activities.

Stephen studied Engineering at Cambridge and worked previously in the Japanese technology sector and internationally as a strategy consultant in the telecom and media sector.

This year sees the 20th anniversary of this conference, and to mark this, this session will bring together 4 experts who all participated in the first ever European Spectrum Management Conference in 2005 to look back at how spectrum policy has evolved— or in some cases, remained consistent — over the past two decades, while also sharing their insights on what lies ahead.

Amit specialises in advising on complex wireless transactions and strategy projects, including supporting mobile operators with spectrum valuation and regulators with the development and implementation of spectrum policy.

Amit has over 25 years of experience advising fixed and mobile operators, regulators/government bodies, financial institutions and equipment manufacturers on commercial, technical and regulatory issues. He has supported several multi-billion dollar M&A and debt financing transactions and has led numerous high-profile studies in the area of radio spectrum policy. Amit brings a global perspective to his work, having undertaken projects for clients in Europe, Asia, the Middle East, Africa, and the Americas.

Amit holds an M.Sc. in Radio Frequency and Communications Engineering from the University of Bradford, UK and an M.B.A. from the University of Warwick, UK.

Richard Marsden specializes in market design, including auctions and trading, bidding strategy, and related competition, pricing, regulatory, and public policy issues. He applies this expertise to multiple industries, including broadcasting, energy, mobile telephony, procurement, radio spectrum, technology, and transport to help his clients create or participate in new marketplaces.

Over the last 20 years, Mr. Marsden has provided guidance to regulators, private companies, and law firms in more than 50 countries. His teams at NERA are particularly well known for their work on the design and implementation of high-value auctions and the development of effective bid strategies. To support this work, the team has developed a suite of software tools for running, simulating, and analyzing auctions.

In the communications sector, Mr. Marsden’s experience includes auction design and implementation, bid strategy advisory work, expert witness reports, and litigation support concerning spectrum allocation, spectrum pricing, spectrum valuation, and mobile market competition. He has advised clients on spectrum auction design and implementation for 4G and 5G mobile spectrum in Belgium, Mexico, Saudi Arabia, Singapore, and South Africa. Mr. Marsden has also provided bid strategy advice to mobile operators participating in auctions for 4G and 5G mobile frequencies in more than 30 countries, including spectrum auctions in Australia, Brazil, Canada, Germany, Spain, the UK, and the US. This work often includes developing or critiquing valuation models. He has also advised on auctions procuring subsidies for broadband rollout.

In the energy sector, Mr. Marsden has designed auctions for electricity interconnection capacity, offshore wind generation sites, and gas pipeline capacity. Additionally, he has advised energy companies participating in capacity markets and offshore wind auctions.

In the technology sector, Mr. Marsden has advised companies on the design of auctions for procurement processes, pricing of used products for resale, and regulatory processes for inducing competition in vertically integrated markets.

Mr. Marsden frequently presents and publishes on topics related to market design, auctions, the communications industry, and spectrum management. He has completed major studies for the GSMA on spectrum pricing and for the European Commission on the transfer of digital dividend spectrum from broadcast to mobile use and on spectrum trading and spectrum liberalization. He contributed a chapter to the Handbook of Spectrum Auction Design on combinatorial auctions and is the co-author of Broadband in Europe: How Brussels Can Wire the Information Society.

More information will be available shortly.

Gérard POGOREL is Professor of Economics and Management-Emeritus, Telecom ParisTech, France, and an independent international expert in telecommunications and the digital economy. Telecom ParisTech is a first-tier European Research and higher education institution. It encompasses all discipline areas, sciences, technologies, social sciences, of relevance to information and telecommunications technologies and the media.

Gérard POGOREL published in 2017 a widely circulated and influential position paper Spectrum 5.0 Improving assignment procedures to meet economic and social policy goals He co-authored in 2014 a report to the Prime Minister of Italy assessing the investments by operators in NGAN networks in the EU Digital Agenda perspective. He was an independent member of the Organo di Vigilanza, of Telecom Italia Open Access (2008-2012) monitoring access to the incumbent’s network. He co-founded and acted as Chair/Rapporteur of the European Spectrum Management Conferences since its creation in 2006. He was previously Chair of the European Union Framework Research & Technology Development Programme Monitoring Panel, and Chair of the Monitoring Committee of the EU Information Society and Technologies Research Programme. He participates in numerous Government-level and regulation Authorities Committees and Scientific Committees on telecom and media policy and regulation in Europe, the USA and Asia. He published numerous articles, books, and reports including: “Spectrum 5.0: improving assignment procedures to meet economic and social policy goals”, “Valuation and pricing of licensed shared access: next generation pricing for next generation spectrum access”, “The digital dividend: radio spectrum, mobile broadband, and the media: Towards a policy framework”, Open Society Institute (2011), “The Radio Spectrum: managing a strategic resource”–with JM Chaduc, (Wiley-ISTEC London, January 2008), Nine regimes of spectrum management: a 4-step decision guide, Communications & Strategies, April 2007.

His current research focuses on the design of network investments incentives, the award of frequency licences, and competitive market dynamics in the digital economy, He is a member of the international panel of experts for the World Competitiveness Yearbook. He lectures extensively in Europe, the US, and Asia. Gérard Pogorel is Officier des Palmes Académiques.

hosted by Broadcast Network Europe (BNE)

With WRC-27 on the horizon, discussions on Europe’s key priorities and regulatory strategies are taking shape. With discussions already underway, stakeholders are starting to outline their priorities, objectives, and strategies for the next cycle, and early indications of Europe’s position on critical agenda items are emerging. This session will look at these and at the areas in which consensus seems likely both within Europe and across Region 1, and where differences are being seen. It will explore the roles of key European stakeholders (CEPT, European Commission, national regulators, and industry stakeholders) and how stakeholders, in developing European plans, can come together to strengthen Europe’s position on key agenda items. It will discuss the initial outcomes of CEPT’s preparatory work, the lessons learnt from WRC-23, and the evolving landscape of spectrum harmonisation across the region. By examining emerging trends, potential challenges, and areas for greater coordination, the discussion will provide insights into how Europe can develop a cohesive and effective strategy for WRC-27.

Stephen is currently Head of International Spectrum Policy in the Spectrum Group in Ofcom (UK) and has been in that position for 9 years. He was the Deputy Head for the UK to CPM23-2 and WRC-23. Stephen has participated in the WRCs in 2012, 2015 and 2019 (in addition to the respective second CPM meetings).

Before his current position, he worked in the Ofcom team concerned with the UK spectrum award of the 10, 28, 32, and 40 GHz bands, in 2008. He also led a spectrum interference investigation team, during the London 2012 Olympics, with staff from the UK and several other CEPT (European Conference of Postal and Telecommunications) administrations.

Stephen has recently been selected as the Chair of the CEPT Group for the WRC-27 period.

During the WRC-23 period Stephen was the Chair of the CEPT Group addressing agenda items related to Science Issues and the CEPT view on the agenda items for WRC-27 and was additionally elected as Vice Chair for the duration of the CEPT CPG-23 process.

Prior to this he served as a Vice Chair of the ECC Working Group for Frequency Management (WG-FM), between June 2014 and November 2020. Whilst in that role he also served as the Chair of the ECC project team addressing the potential for “Wi-Fi” and similar systems in the 5925 – 6425 MHz band, that was subject to a European Commission Mandate.

Stephen has had a diverse exposure to a wide variety of spectrum sectors and disciplines, under the WRC processes and of the harmonisation functions of ECC.

Stephen holds a Higher National Certificate (HNC) in electronic and electrical engineering and has been with Ofcom since its inception in December 2003. Before Ofcom, Stephen worked at the Radiocommunications Agency (the Government predecessor to Ofcom) in several posts: Radio Investigation and Monitoring, Satellite and Space Sciences and the International Regulation Team.

Stephen is married with a family. He enjoys home mechanics, motorcycles, electronics and home improvements.

Jeppe Tanderup Kristensen is Chief Adviser at the Agency for Data Supply and Infrastructure, the Danish government agency in charge of spectrum management. His responsibilities include representing the interests of Denmark in the ITU, CEPT, and EU on spectrum matters, among others.

He was head of delegation for Denmark at WRC-23 and PP-22 and deputy head at WRC-19 and PP-18.

He has been a delegate to Radio Spectrum Policy Group (RSPG) since 2022.

Jeppe has, in his career with the agency, been involved in multiple spectrum auctions.

Jeppe holds an M.Sc. from the Technical University of Denmark.

Renate Nikolay is deputy director general at DG Connect. Before that, she was head of cabinet of Vera Jourova, the European commissioner for justice, consumers and gender equality. Before that, she led the Unit of interinstitutional and international relations in DG Justice between 2011 and 2014.